|

Singapore Airlines has completed sale-and-leaseback

transactions for eleven aircraft, comprising seven Airbus

A350-900s and four Boeing 787-10s, raising approximately S$2

billion (approximately US$1.5 billion) in total.

SIA has successfully raised approximately S$15.4

billion in fresh liquidity since 1 April 2020, including these

latest

sale-and-leaseback transactions.

The amount also includes S$8.8

billion from SIA�s successful rights issue, S$2.1 billion from

secured financing, S$2.0 billion via the issuance of convertible

bonds and notes, as well as more than S$500 million through new

committed lines of credit and a short-term unsecured loan.

SIA continues to have access to more than S$2.1

billion in committed credit lines, along with the option to raise

up to S$6.2 billion in additional mandatory convertible bonds

before the Annual General Meeting in July 2021.

Mr Goh Choon Phong, Singapore Airlines Chief

Executive Officer, said, �The additional liquidity from these

sale-and-leaseback transactions reinforces our ability to navigate

the impact of the Covid-19 pandemic from a position of strength.

We will continue to respond nimbly to the evolving marketing

conditions, and be ready to capture all possible growth

opportunities as we recover from this crisis.�

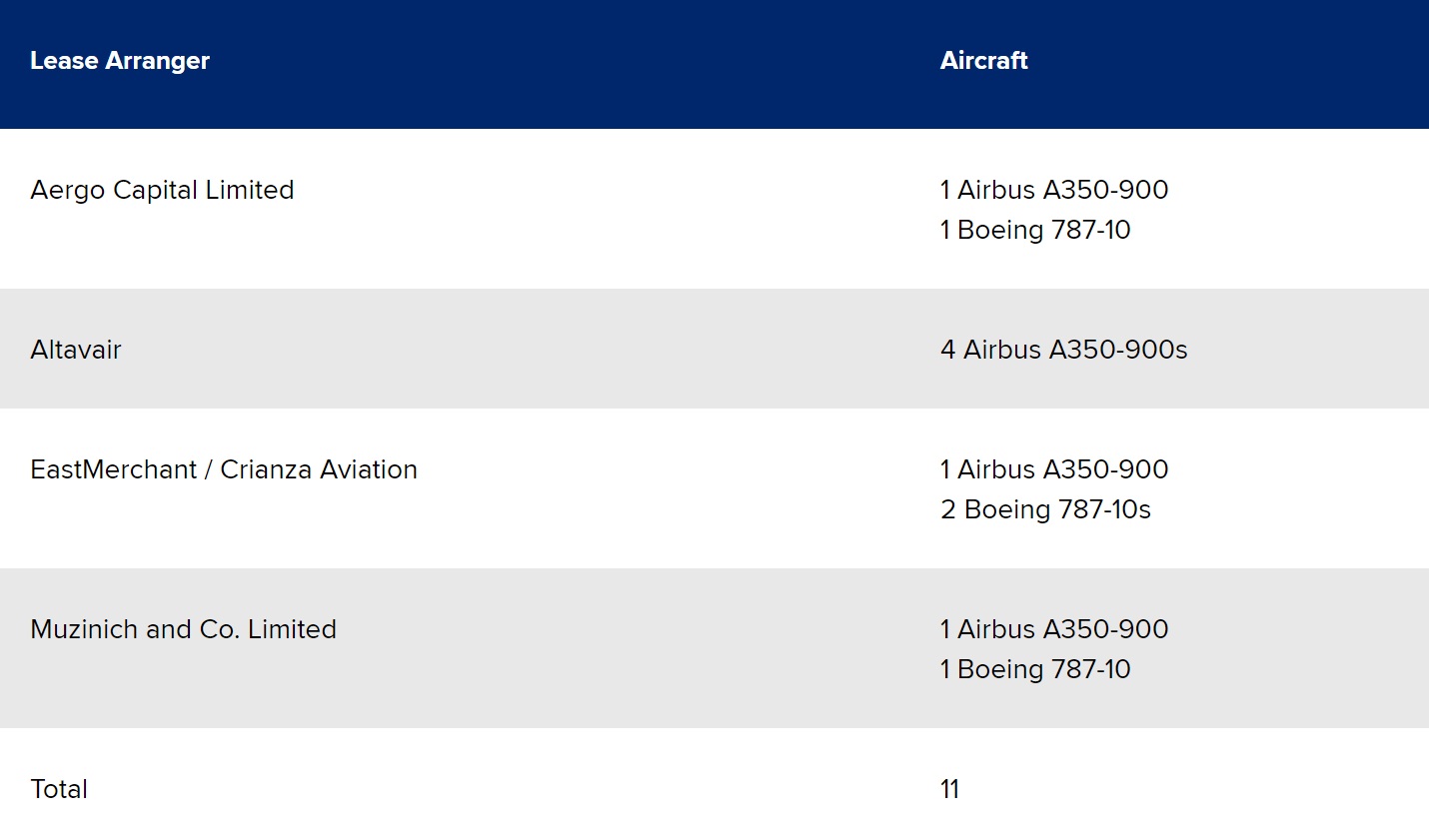

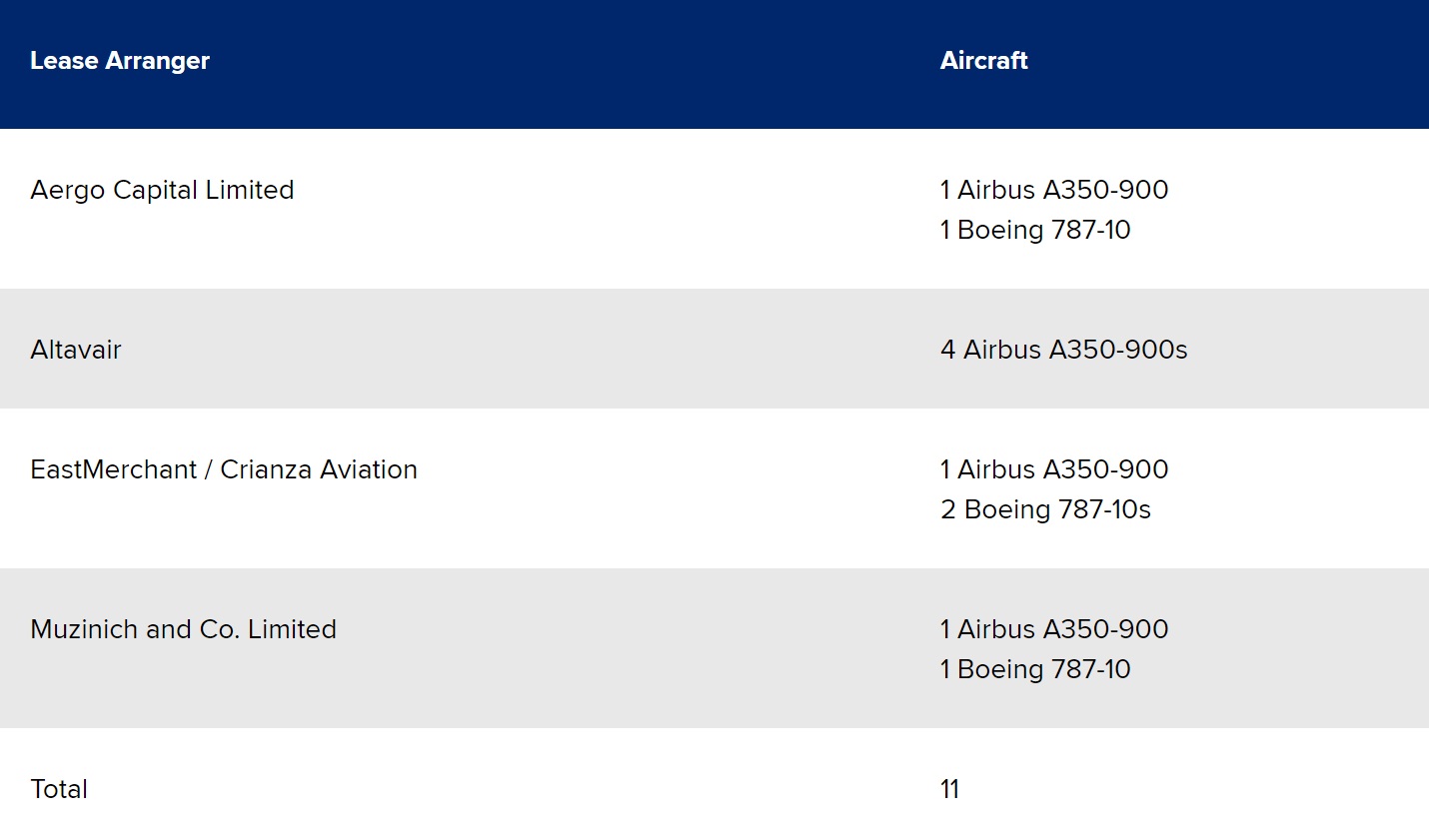

The transactions were arranged by four different

parties, as follows:

See latest

Travel Industry News,

Video

Interviews,

Podcasts

and other

news regarding:

COVID19,

SIA,

Singapore Airlines,

Singapore.

|

Headlines: |

|

|