|

IATA's May 2021 data for global air cargo markets shows that

demand continued its strong growth trend.

Global demand, measured in cargo tonne-kilometers (CTKs), was up 9.4%

when compared to May 2019.

Seasonally adjusted demand rose by 0.4% month-on-month, the

13th consecutive month of improvement.

The pace of growth

slowed slightly in May compared to April which saw demand increase

11.3% against pre-COVID19 levels (April 2019). Notwithstanding,

air cargo outperformed global goods trade for the fifth

consecutive month.

North American carriers contributed 4.6

percentage points to the 9.4% growth rate in May. Airlines in all

other regions except for Latin America also supported the growth.

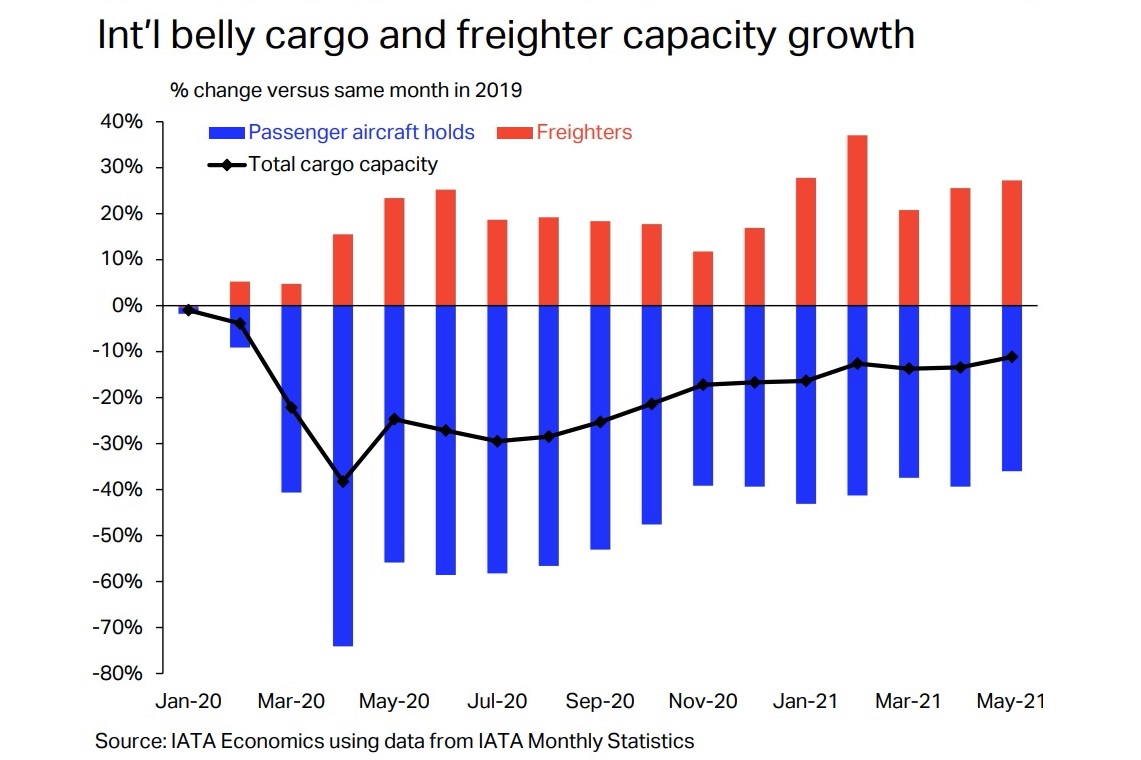

Capacity remains constrained at 9.7% below pre-COVID19

levels (May 2019) due to the ongoing grounding of passenger

aircraft. Seasonally adjusted capacity rose 0.8% month-on-month in

May, the fourth consecutive month of improvement indicating that

the capacity crunch is slowly unwinding.

Underlying economic

conditions and favourable supply chain dynamics remain supportive

for air cargo:

- Global trade rose 0.5% in April.

- The

Purchasing Managers Indices (PMIs), leading indicators of air

cargo demand, show that business confidence, manufacturing output

and new export orders are growing at a rapid pace in most

economies.

- The cost-competitiveness of air cargo relative to

that of container shipping has improved. Pre-crisis, the average

price of air cargo was 12 times more expensive than sea shipping.

In May 2021 it was six time more expensive.

�Propelled by strong economic growth in trade and

manufacturing, demand for air cargo is 9.4% above pre-crisis

levels,� said Willie Walsh, IATA�s Director General. �As economies

unlock, we can expect a shift in consumption from goods to

services. This could slow growth for cargo in general, but

improved competitiveness compared to sea shipping should continue

to make air cargo a bright spot for airlines while passenger

demand struggles with continued border closures and travel

restrictions.�

Asia-Pacific airlines saw demand for international

air cargo increase 5.3% in May 2021 compared to the same month in

2019. This was a decrease compared to the previous month (5.9%)

due to a slight slowdown in growth in several large trade routes within Asia. International capacity remained constrained in the

region, down 16.9% versus May 2019. As was the case in April, the

region�s airlines reported the highest international load factor

at 75.2%.

North American carriers posted a 25.5%

increase in international demand in May 2021 compared to May 2019.

This was on par with April�s performance (25.4%) and the strongest

of all regions. Underlying economic conditions and favorable

supply chain dynamics remain supportive for air cargo carriers in

North America. International capacity grew by 1.6%compared with

May 2019.

European carriers posted an 5.7% increase in

demand in May 2021 compared to the same month in 2019. This was a

decrease in performance compared to the previous month (11.5%) due

to a slight slowdown in growth on key trade routes including

Europe � Asia and Within Europe. International capacity decreased

by 17.3% in May 2021 versus May 2019, remaining unchanged from the

previous month.

Middle Eastern carriers posted a

14.1% rise in international cargo volumes in May 2021 versus May

2019. This was a slight decrease compared to the previous month

(15.6%). Seasonally adjusted volumes remain on a robust upward

trend. International capacity in May was down 6.1% compared to the

same month in 2019, a robust improvement from the 10.1% drop in

April.

Latin American carriers reported a decline

of 14% in international cargo volumes in May compared to the 2019

period. This was the worst performance of all regions, but a

significant improvement compared to the previous month, which saw

a 32.3% drop in demand. Seasonally adjusted demand also rose

strongly in May. International capacity decreased 24.9% compared

with May 2019, an improvement over the 52.3% decrease in April.

African airlines� cargo demand in May increased

24.5% compared to the same month in 2019. This was a decrease in

performance compared to the previous month (34.0%) due to a

slowdown in trade flows between Africa and Asia. May international

capacity increased by 0.5% compared to May 2019, remaining

relatively unchanged from April.

The complete Air Cargo Market Analysis for May

2021 can be downloaded in .pdf format

here.

Note: As

comparisons between 2021 and 2020 monthly results are distorted by

the extraordinary impact of COVID19, unless otherwise noted, all

comparisons above are to May 2019 which followed a normal

demand pattern.

See latest

Travel Industry News,

Video

Interviews,

Podcasts

and other

news regarding:

IATA,

Cargo,

Freight,

Traffic.

|

Headlines: |

|

|