|

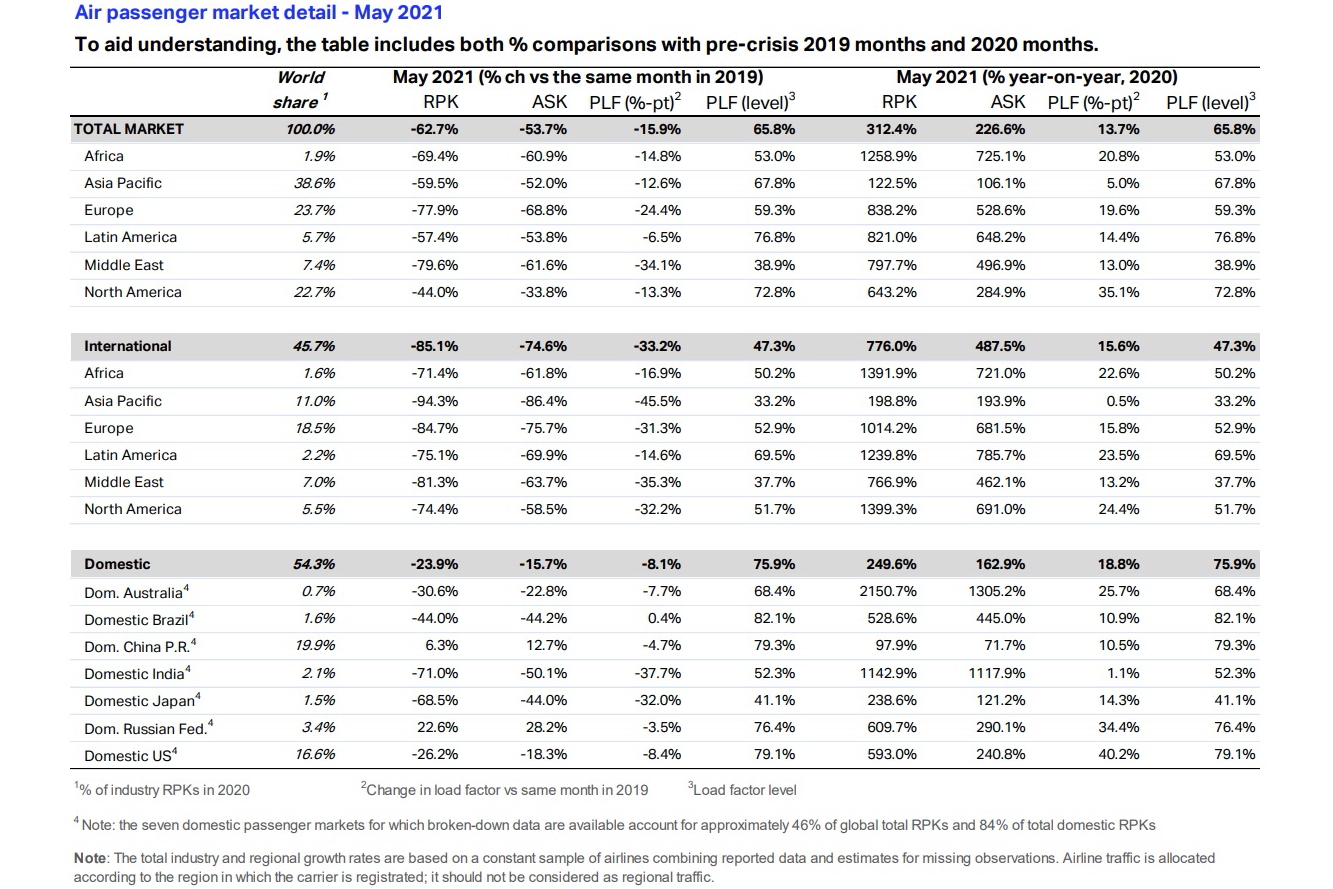

According to IATA, both international and domestic travel demand showed

marginal improvements in May 2021 when compared to April, though

traffic remained well below pre-pandemic levels.

Recovery in international traffic in particular

continued to be stymied by extensive government travel

restrictions.

Total demand for air travel in May 2021, measured

in revenue passenger kilometers (RPKs), was down 62.7% when compared

to May 2019, a gain over the 65.2% decline recorded in

April 2021 versus April 2019.

International passenger demand in May was 85.1%

below May 2019, a small step-up from the 87.2% decline recorded in

April 2021 versus two years ago. All regions with the exception of

Asia-Pacific contributed to this modest improvement.

Total domestic demand was down 23.9% versus

pre-crisis levels (May 2019), slightly improved over April 2021,

when domestic traffic was down 25.5% versus the 2019 period.

China

and Russia traffic continue to be in in positive growth territory

compared to pre-COVID19 levels, while India and Japan saw

significant deterioration amid new variants and outbreaks.

�We are starting to see positive developments,

with some international markets opening to vaccinated travelers,�

said Willie Walsh, IATA�s Director General. �The Northern

Hemisphere summer travel season is now fully arrived. And it is

disappointing that more governments are not moving more rapidly to

use data to drive border opening strategies that would help revive

tourism jobs and reunite families.�

European carriers� May international traffic

declined 84.7% versus May 2019, improved from the 87.7% decrease

in April compared to the same month in 2019. Capacity dropped

75.7% and load factor fell 31.3 percentage points to 52.9%.

Asia-Pacific airlines saw their May international

traffic fall 94.3% compared to May 2019, fractionally worse than

the 94.2% drop registered in April 2021 versus April 2019. The

region experienced the steepest traffic declines for a tenth

consecutive month. Capacity was down 86.4% and the load factor

sank 45.5 percentage points to 33.2%, the lowest among regions.

Middle Eastern airlines experienced an 81.3%

demand drop in May compared to May 2019, slightly bettering the

82.9% decrease in April, versus the same month in 2019. Capacity

declined 63.7%, and load factor fell 35.3 percentage points to

37.7%.

North American carriers� May demand fell 74.4%

compared to the 2019 period, an improvement over the 77.6% decline

in April versus two years ago. Capacity sagged 58.5%, and load

factor dropped 32.2 percentage points to 51.7%.

Latin American airlines saw a 75.1% demand drop in

May, compared to the same month in 2019, notably improved over the

80.9% decline in April compared to April 2019. May capacity was

down 69.9% and load factor decreased 14.6 percentage points to

69.5%, which was the highest load factor among the regions for the

eighth consecutive month.

African airlines� traffic fell 71.4% in May versus

May two years ago, a gain from the 75.6% decline in April compared

to April 2019. May capacity declined 61.8% versus May 2019, and

load factor dropped 16.9 percentage points to 50.2%.

Domestic Passenger Markets

India�s domestic traffic fell 71.0% in May

compared to May 2019 amid the emergence of the new and more

contagious �Delta� variant. This compared to a 42% decline

registered in April versus the same month two years ago.

Brazil�s domestic traffic rebounded from a 60.9%

decline in April versus the same month in 2019, to a 44% decline

in May, as travel restrictions were eased.

Vaccinated Travelers Pose Very

Little Risk to Local Populations

�To paraphrase an old saying, when you think that

all you have is a hammer, every problem looks like a nail. Too

many governments continue to act as if the only tool in their

anti-COVID19 arsenal is a blanket border closure or an arrival

quarantine. In fact, research from leading medical organizations

around the globe confirms that vaccinated travelers pose very

little risk to the local population while data show that

pre-departure testing largely removes the risk of unvaccinated

travelers importing COVID19,� said Walsh. �It is long past time

for governments to start responding to this information with more

nuanced data-driven risk-based strategies. These will minimize the

chance of importing COVID19 while allowing the world to reopen to

travel and all the opportunities it brings to reconnect with loved

ones, to realize business opportunities, to explore the world or

take a well-deserved vacation.�

The complete Air Passenger Market Analysis for May

2021 can be downloaded in .pdf format

here.

Note: Because comparisons between 2021 and 2020 monthly

results are distorted by the extraordinary impact of COVID19,

unless otherwise noted all comparisons above are to May 2019, which

followed a normal demand pattern.

See also:

What is the IATA Travel Pass, and what does it mean for

travellers, airlines and the global travel industry? Exclusive

video interview with Vinoop Goel.

See latest

Travel Industry News,

Video

Interviews,

Podcasts

and other

news regarding:

IATA,

RPK,

ASK,

Traffic.

|

Headlines: |

|

|